Back to Blog

7 min read

A Complete Guide to Registering as a Sole Proprietor Business in Kenya

Published onNovember 13, 2024

Introduction

Starting a sole proprietorship is an ideal choice for many first-time entrepreneurs and small business owners in Kenya due to its simplicity, low costs, and straightforward setup process. This guide provides everything you need to know about registering a sole proprietorship in Kenya, including the legal requirements, registration steps, costs involved, and essential tips to ensure smooth operations. Whether you’re a budding entrepreneur or a professional looking to formalize your trade, this guide is crafted to help you navigate the process successfully.

1. Understanding Sole Proprietorship in Kenya

A sole proprietorship is the simplest business structure, where a single individual owns, manages, and controls the business. Unlike limited companies, a sole proprietorship has fewer legal formalities, which makes it easier to establish. However, sole proprietors assume full personal responsibility for the business’s liabilities and debts, making it essential to understand the implications of this structure.

Key characteristics:

Owned by a single individual

Limited regulatory and tax obligations

Full personal liability for business debts

2. Benefits and Limitations of a Sole Proprietorship

Benefits

Ease of Setup and Operation: The process of registering a sole proprietorship is quick and affordable compared to other business structures.

Complete Control: As the sole owner, you have full authority over all decisions related to the business.

Tax Benefits: Sole proprietors often benefit from a simpler tax structure with fewer filings and tax deductions for business expenses.

Flexible Management: Operations can be easily managed without the need for complex governance or board meetings.

Limitations

Unlimited Liability: The business owner is personally liable for all business debts, which means personal assets can be used to settle business liabilities.

Limited Growth Potential: Raising funds may be challenging, as investors typically prefer incorporated entities with more defined structures.

Limited Lifespan: The business is typically dependent on the owner’s continued involvement and ceases to exist if the owner withdraws or passes away.

Understanding these pros and cons helps entrepreneurs decide if a sole proprietorship aligns with their goals and risk tolerance.

3. Legal Requirements for Registering as a Sole Proprietor in Kenya

The Kenyan government, through the Business Registration Service (BRS), mandates that all businesses must be registered to ensure legality and compliance with regulations. The legal requirements to register as a sole proprietor are straightforward:

Nationality: Applicants must be Kenyan citizens.

Age: Individuals must be at least 18 years old.

ID and KRA PIN: The applicant’s national ID and Kenya Revenue Authority (KRA) Personal Identification Number (PIN) are mandatory for registration.

Business Name Approval: A unique business name must be approved and reserved through the eCitizen platform.

Meeting these basic requirements ensures eligibility for sole proprietorship registration in Kenya.

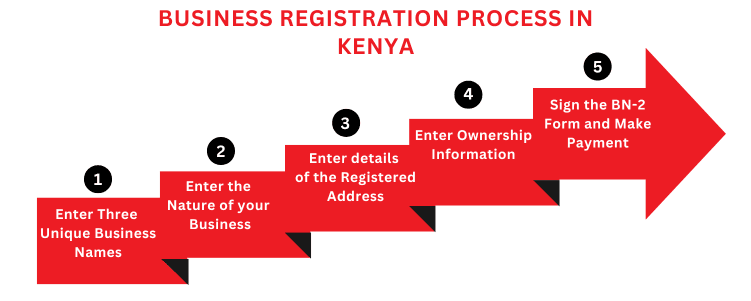

4. Step-by-Step Process for Registering a Sole Proprietorship

Below is a detailed step-by-step guide for registering a sole proprietorship in Kenya through the eCitizen portal.

Step 1: Creating an eCitizen Account

Visit eCitizen and create a new account if you don’t already have one.

Register using your ID number and KRA PIN to ensure full access to business services.

Step 2: Business Name Search and Reservation

Log into your eCitizen account and select the Business Registration Service.

Choose “Name Search” and enter your preferred business name.

The system checks if the name is available. If approved, you can reserve it for a small fee (typically around Ksh 150).

Reserved names are valid for 30 days, giving you time to complete the registration.

Step 3: Filling Out the Business Registration Form

Go to the “Business Registration” section and select “Register Business.”

Complete the form by providing details such as business name, physical address, and type of business (sole proprietorship).

The form will also require you to include information like your KRA PIN, phone number, and email address for communication.

Step 4: Paying the Registration Fees

Pay the registration fee (typically around Ksh 1,000) via mobile money, credit card, or bank transfer as instructed on the eCitizen portal.

Once payment is processed, you’ll receive a confirmation via email.

Step 5: Submission and Approval

Review all information entered to ensure accuracy before submission.

Submit the application, after which it is reviewed by the Business Registration Service.

Approval usually takes a few days, and upon approval, a digital certificate of registration will be issued.

Step 6: Downloading the Certificate

Once approved, log into your eCitizen account, navigate to the completed applications section, and download the certificate of registration.

This certificate serves as proof of legal registration and can be presented for banking, contracting, and other official purposes.

5. Costs Involved in Registering a Sole Proprietorship

The costs of registering as a sole proprietor are relatively low, making it affordable for many entrepreneurs.

Name Search Fee: Ksh 150 (approximately)

Registration Fee: Ksh 1,000

Optional Costs: Additional costs may arise if you hire a lawyer or an agent to assist with the process.

6. Compliance and Regulatory Requirements

Once registered, sole proprietors in Kenya have additional compliance requirements:

Tax Registration

Register with the Kenya Revenue Authority (KRA) for a Business Personal Identification Number (PIN) to facilitate tax compliance.

File taxes annually and remit VAT if the business earns above Ksh 5 million annually.

Business Permit

Obtain a Single Business Permit from your county government, as required by law. The fees vary based on the location and nature of the business.

Social Security Contributions

If you have employees, register for the National Social Security Fund (NSSF) and the Social Health Authority (SHA).

Meeting these compliance requirements ensures that your sole proprietorship operates legally within Kenya.

7. Tax Obligations for Sole Proprietors in Kenya

Kenya’s tax regime for sole proprietors is relatively straightforward. Below are the main tax requirements for sole proprietors:

Income Tax

Sole proprietors report business income as personal income, taxed under the individual tax rates.

VAT Registration

If the annual turnover exceeds Ksh 5 million, registration for VAT is mandatory, requiring regular VAT returns and payments.

Turnover Tax (TOT)

Applicable to small businesses with an annual turnover between Ksh 1 million and Ksh 50 million.

TOT is charged at a rate of 1% on gross sales and is filed quarterly.

Understanding and adhering to these tax obligations ensures compliance and helps avoid penalties.

8. Essential Tips for Running a Successful Sole Proprietorship

Success as a sole proprietor in Kenya goes beyond registration. Here are some crucial tips:

Financial Management

Keep personal and business finances separate, even though sole proprietors are not legally required to do so.

Track all business income and expenses, using tools or apps to simplify financial management.

Marketing and Customer Service

Build a solid online presence, particularly on social media, to reach a broader audience.

Excellent customer service builds a loyal customer base and enhances reputation.

Networking and Partnerships

Attend networking events and join business associations to learn from other entrepreneurs and establish valuable contacts.

Continuous Learning and Adaptation

Stay updated on market trends, customer preferences, and technological advancements to keep your business competitive.

9. Challenges of Running a Sole Proprietorship

Operating as a sole proprietor has its challenges:

Limited Funding Options

Banks and investors often prefer companies with a formal structure and limited liability, making it harder to secure funding as a sole proprietor.

High Liability Risk

Personal liability for business debts exposes sole proprietors to the risk of losing personal assets if the business encounters financial difficulties.

Business Longevity

A sole proprietorship may struggle with continuity issues, as it is often tied to the owner’s active involvement.

Despite these challenges, many sole proprietors in Kenya thrive by leveraging strong business strategies, innovation, and adaptability.

Registering as a sole proprietor is a practical, cost-effective way to start a business in Kenya. This guide has walked you through the registration steps, legal requirements, and compliance obligations, equipping you with the knowledge to operate successfully. As you embark on this entrepreneurial journey, remember that a strong business foundation and continuous learning are keys to sustainable growth and success in Kenya’s dynamic market. With the right approach, your sole proprietorship can grow into a robust business venture, creating opportunities for you and the wider community.

Related Services

Need Expert Assistance?

Our team can handle the entire application process for you.